![]()

Tier's hardware prowess is well-established, but software will be the key differentiator for future success. Then, what turning point awaits Tiers as software takes center stage? Lee Soon-cheol, Vice President of FESCARO, discusses Tier's development status, hurdles, and future roadmap.

Author | Lee Soon-cheol, Vice President, FESCARO

Lee Soon-cheol, Vice President

He started his career as an application engineer at

BOSCH and progressed through project manager and sales roles to an executive. He

then led the Korean branch of Elektrobit, a company specialized in automotive

middleware, during the Electric Vehicle boom. Now, he leverages his 30 years of

international experience to spearhead the expansion of next-gen controller

business for SDV at FESCARO.

* This article was crafted through a collaborative

approach, leveraging 70% raw expertise and 30% AI assistance.

Four Changes in the Automotive Ecosystem Triggered by Electrification

Electrification's impact on the

automotive industry has reshaped its ecosystem. Below is the four Key changes:

First, the Tiering between automakers

(OEMs) and controller developers (Tier) has crumbled. Semiconductor

manufacturers used to trade with Tiers, but now they’re dealing directly with

OEMs. As vehicles began to require high-performance graphics processing, signal

processing, and communications, etc., semiconductor manufacturers started to provide

integrated solutions such as autonomous driving, connectivity, safety, and

entertainment systems.

Second, the boundaries in the industry

have collapsed. Mobility service providers are emerging separately from

traditional OEMs. They are introducing new competitive elements into the

automotive industry by offering autonomous taxi services, shared mobility

platforms, demand-responsive vehicle-hailing services, and drone delivery

services.

Third, the distinction between

competitors and partners has become ambiguous. As the adoption of electric

vehicles expands, OEMs are putting significant effort into establishing and

expanding electric vehicle charging infrastructure. In this process, OEMs

between themselves or electric vehicle charger companies become partners and

share the infrastructure, or competitors depending on the region.

Fourth, the automotive industry

is witnessing a surge in software adoption. This is driven by several factors:

cost-effective software development, its ability to implement functionalities

such as autonomous driving, connectivity, safety, and entertainment into

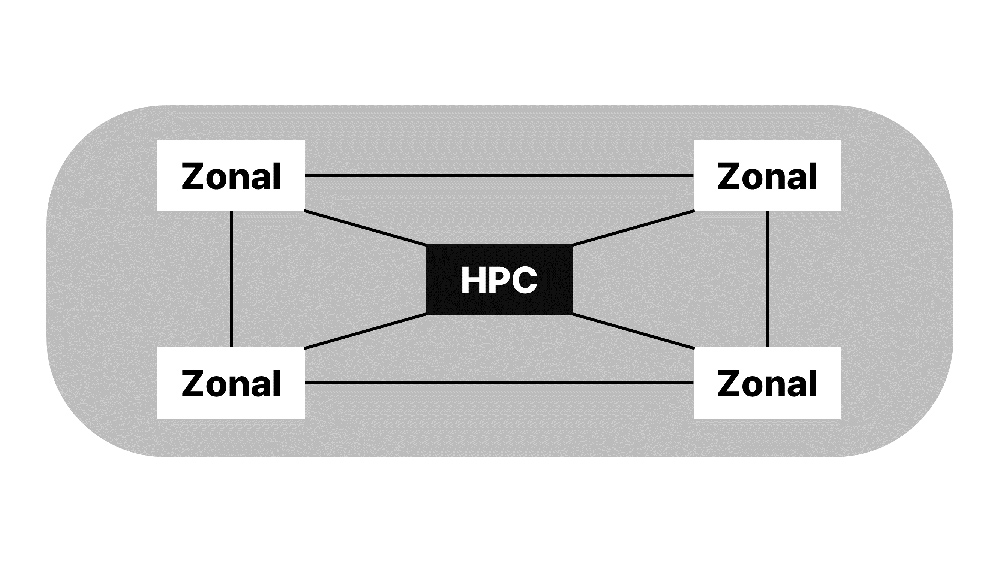

software, and ease of update & maintenance. Most OEMs aim to develop

Software-Defined Vehicles (SDV). Implementing SDV requires a transition to a

zonal vehicle architecture, and high-performance computing (HPC) must be presupposed

for autonomous driving, artificial intelligence, and real-time data analysis. The

future holds promise for even deeper software integration within zonal or HPC.

The hardware development capabilities of Tiers have already reached a significant level. The software implementing these functions will be a key differentiator in future competition. Then, as the importance of software increases, what turning point will Tiers face? Let's discuss about Tier’s development status, hurdles to overcome, and direction to move forward.

Development Status of Tiers (Classified into four groups)

Tiers can be classified into four

groups according to their business area. Let's take a look at the development

status of global Tier 1 to Tier 2.

The first group is global Tier 1.

They supply control units to global OEMs and operate domestic and overseas

factories. They have sufficient in-house hardware and software development

human resources. Software human resources from small and medium Tier 1

companies and IT companies are moving here, and they are partnering with

universities to support students with scholarships and connect them with

employment. This mirrors the intense competition for talent once seen in the IT

and gaming industry. Engineers recruited through scouting often move to OEMs

after gaining 1 to 2 years of experience, so there is no absolute assurance

regarding workforce issues.

The second group consists of Tier

1 companies that have domestic OEMs as their main customers and also supply

control units to some overseas OEMs. While they possess a moderate software

development workforce, their workforce for concurrent mass production and

advanced development is limited. To address this, they strategically deploy

their human resource, focusing internal talent on advanced development while

collaborating with external specialists for mass production needs. In addition,

most companies have their research centers in the capital region, but some with

research centers located in rural areas choose to relocate only the software

department to the vicinity of the capital to operate an affiliated research

center. This decision is seen as a consideration of the concentration of talent

in the capital region. This phenomenon is also observed among some foreign

companies operating in Korea.

The third group consists of Tier

1 companies that mainly serve domestic OEMs while positioning themselves for

future overseas expansion. Their operations, including headquarters and

research centers, are concentrated outside the capital region. They develop

lower-level control units rather than upper-level control units for vehicles.

Many of the existing software developers have moved to Tier 1 companies, which

have research centers located globally or in the capital, and because it is

difficult to recruit experienced and new employees, they collaborate with

external specialized companies for mass production and advanced development.

The fourth group is Tier 2. The

hardware is developed in-house, and the software is provided by Tier 1. Because

they primarily develop and produce products that are closer to sensors than

control units, there are almost no software engineers in their research

centers. However, some companies possess specialized technology for specific

components. They see the current shift towards electrification in the

automotive ecosystem as an opportunity to expand their control unit development

capabilities.

We have checked the development

status of Tiers by group. Next, let's find out what hurdles the Tier must

overcome based on this current situation.

Three Hurdles that Tiers face in

The Era of SDV

Shortage of Software Human Resources

The rapid rise in software demand

within the automotive industry outpaces supply, leading to a shortage of software

engineers. Engineers are being drawn to global Tier 1 and OEMs. In a capitalist

economy, workers can seek companies that offer higher wages and better working

conditions depending on their abilities and experience, which contributes to

increasing the flexibility of the labor market. As further evidence, a 2022

survey by JOBKOREA, a Korean recruitment platform, revealed that ‘opportunities

for learning and growth’ are the biggest motivator for job changes among

workers in their 20s and 30s. 1)

If companies want to secure

talent, the key is to focus on career development, such as whether the company

has specialized expertise or can provide diverse or new experiences.

Recognition of software value

As software influence expands and

competition for workforce intensifies, it is evident that software will become a

key corporate asset in the future. However, in the automotive industry, the

value of software tends not to be reflected in terms of price. So far, software

has been included in the price of the control units. However, considering the

situation in which SDV will be composed of Zonal and HPC in the future, OEMs may

seek to procure software independent of control units developed by the existing

Tier 1 companies and embed it in the vehicle. Although developing all functions

is an option for OEMs, it is not easy to develop all while avoiding various

patents. To truly advance toward SDV, practical solutions for software pricing

between OEMs and Tier 1 companies are essential.

Developing Innovative Ideas

The shortage of software human

resources may be partially alleviated through collaboration with AI. While AI can

handle coding tasks, engineers will remain crucial for results verification,

and the strategic implementation of creative ideas that drive new services. As

the value of innovative software solutions increases, the industry should

explore ways to incentivize creative thinking among software engineers.

Tiers should prioritize

developing ideas for survival strategies in the SDV era, while strongly considering

implementing actual development through collaboration and partnerships with

external specialized companies. This can be an effective tool for boosting

productivity by shortening the development period, etc. Furthermore, Software

Development Kits (SDKs) should be provided to allow developers to easily

integrate the functions required for solutions without implementing separate

functions. Just as various applications are used on smartphones, new services

will be developed and used in vehicles in the future based on numerous

information exchanged through networks inside and outside the vehicle. Tiers

should also consider venturing into the development of in-vehicle applications.

If you have 70% of the ideas, you

now need 30% of creativity. At the beginning, I stated that this article was

written with 70% experience and 30% AI support. While daily journaling might

not demand extensive thought, crafting an insight column requires a different level of thinking. Then,

I felt that I could write more easily with the help of AI. First of all, I

quickly wrote down my observations and discoveries within the field. AI then

facilitated the completion of the writing, offering support in areas, such as sentence

flow, sourcing relevant materials, and identifying appropriate terminology.

If you have an innovative

software idea for SDV but are at a loss on how to implement it, it is similar

to my situation, which had raw ideas in writing this column. I believe that for

Tiers, 70% of development has already been completed with just a creative idea.

The important thing is to transform the idea into reality. I dare to

predict that companies with the “creativity” to execute ideas without a guideline

will be the key drivers of innovation. For those possessing 70% of the ideas,

the remaining 30% will be provided by software-specialized companies like

FESCARO, which will offer the most practical solutions to implement ideas.